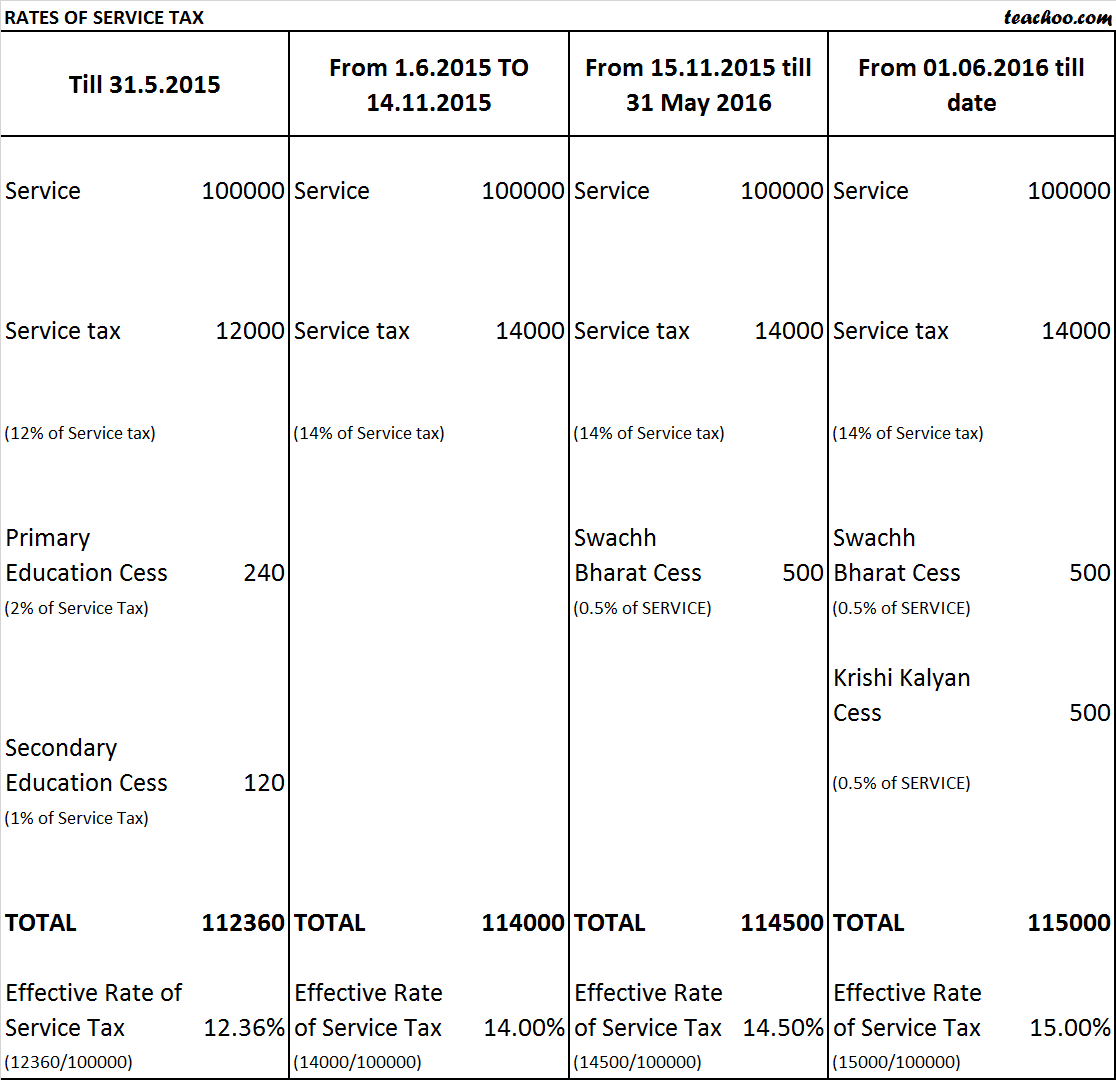

april 2016 service tax rate

Description of service provided Existing Taxable Value Taxable value after amended Abatement 2 Transportation of goods by rail by Indian Railways 30 without Cenvat credit 30 with input service Cenvat credit 2A Transportation of goods in containers by rail by other than Indian Railways 30 without Cenvat credit 40 with input service Cenvat credit 3. Tax Rates 2016 1 For Tax Years 1988 through 1990 the tax rate schedules provided only two basic rates.

Changes applicable from 1st April 2016.

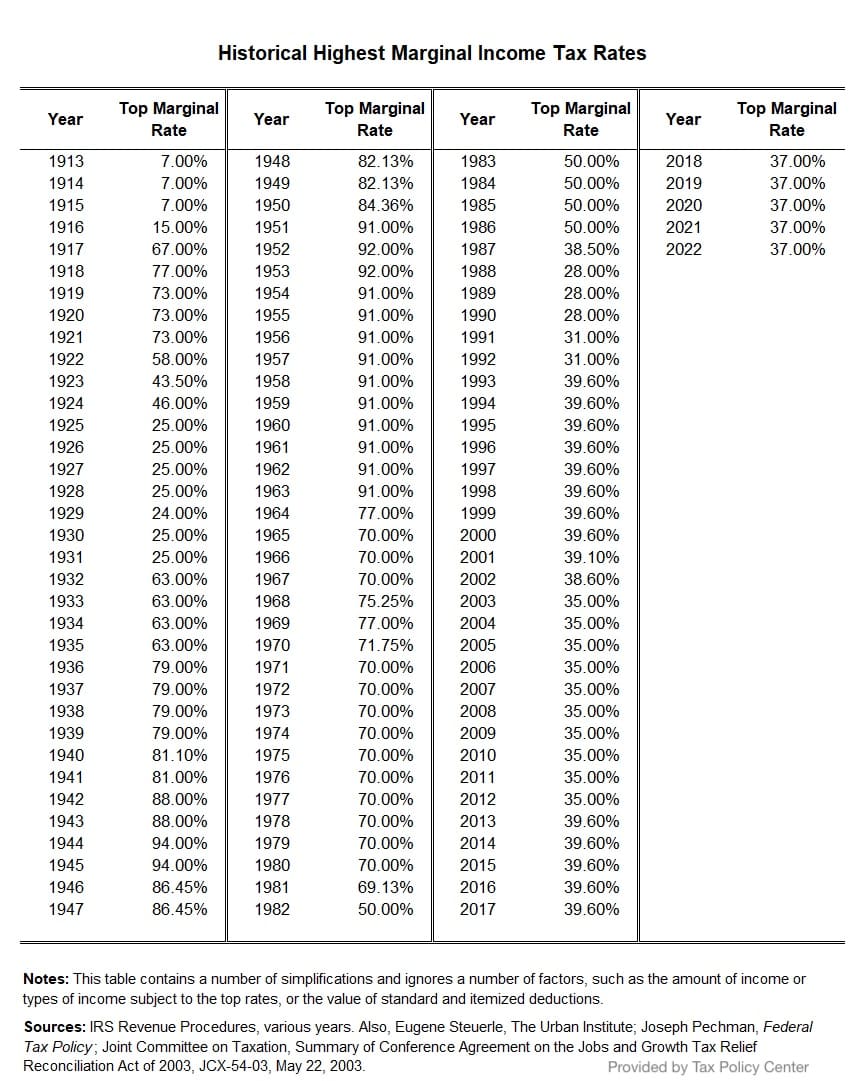

. If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be referred. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at. For detail article about service tax changes applicable from 1416 read here.

16 rows 42 1430 435 14530 45 1530 Effective from 01042016 a uniform abatement at the. The service tax rate may get changed by Budget 2016 from 145 to 16. Presently in cases where the amount allocated for investment or savings on behalf of policy holder is not intimated to the policy holder at the time of providing of service an insurer is required to pay tax 35 of the premium charged from policy holder in the first year and 175 of the premium charged from policy holder in the subsequent years.

Ad Honest Fast Help - A BBB Rated. For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. April brings local rate changes a state rate change and a new Internet sales tax.

Start wNo Money Down 100 Back Guarantee. Service tax rate 145 is applicable for period during 142016 to 3152016. So all goods including household goods were covered.

Ad Manage exemption documents calculate rates apply custom rules generate reports. 15 percent and 28 percent. However taxable income over certain levels was subject to a 33-percent tax rate to phase out the benefit of the 15-percent tax bracket as compared to the 28-percent rate and the deduction for personal exemptions.

Cenvat credit on input input services and capital goods are not available. Earlier this is applicable for Services of goods transport agency in relation to transportation of goods. You may also like to read Chapter V of Finance Act 1994.

Avalaras pre-built Infor integration makes getting started easier. Cenvat Credit of Input Input Service Capital Goods used for providing the said service is not availed. Penal Rate in case of tax collected but not deposited to exchequer.

When Are Taxes Due In 2022 Forbes Advisor

The Impact Of Gst On Varied Business Areas Gst Gstbill Business Tax Goods And Service Tax Business Challenge

Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times

Income Tax History Tax Code And Definitions United States

Usa Finance And Payments Live Updates 2 753 Monthly Check Tax Deadline 2022 Gas Stimulus Check As Usa

Digital Services Tax Dst Global Tracker

Irs No Penalty For Filing Taxes Late If You Re Getting A Refund

2022 Federal State Payroll Tax Rates For Employers

How Does The Deduction For State And Local Taxes Work Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Tax Principles Relx Information Based Analytics And Decision Tools

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf Accounting Taxation Tax Tax Payment Due Date

What Is The Rate Of Service Tax For 2015 16 And 2016 17