who pays transfer tax in philadelphia

BIRT Wage NPT Earnings Liquor SIT Beverage and Tobacco. The tax is usually split evenly between the buyer and the seller but this is not a legal requirement.

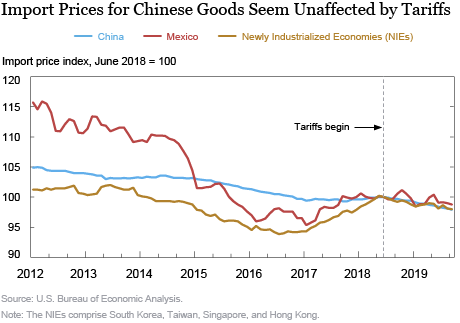

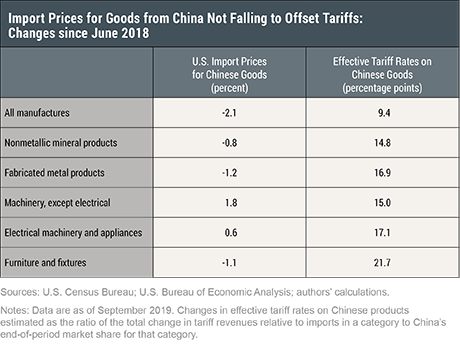

Who Pays The Tax On Imports From China Liberty Street Economics

This includes a 107 recording fee 107 Philadelphia Housing Trust Fund fee 050 State Writ Tax 2 County fee and 4025 Access to Justice fee.

. For comparison Montgomery County Pennsylvanias transfer tax is only 1. The amount of Philadelphia Pennsylvania real estate transfer taxes is calculated by the sale price of the home and the tax rate of 2. Who pays Philadelphia transfer tax.

Pennsylvania imposes a 1 transfer tax on the value of the real estate being transferred while Philadelphia imposes a 3278 tax on the value of the real estate being transferred. The tax is usually split evenly between the buyer and the seller but this is not a legal requirement. Documents showing ownership include.

In most cases the buyer will pay 2139 and the seller will pay 2139. From now on use the Philadelphia Tax Center to file and pay the following taxes electronically. The Recorders of Deeds remit the commonwealths 1 percent to the Department of Revenue and the locals have the option to share their realty transfer tax among.

The Buyer or the Seller. The tax becomes payable when a property deed or other document showing realty ownership is filed with the Records Department. According to the Pennsylvania Department of Revenue both the seller and buyer are held jointly liable for the payment of transfer tax.

What that means is that the two parties often split the cost equally between themselves. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. The tax is usually split evenly between the buyer and the seller but this is not a legal requirement.

For help getting started or for answers to common questions please see our online tax center guide. Long-term leases 30 or more years Easements. Pennsylvania realty transfer tax is collected often along with an additional local realty transfer tax by county Recorders of Deeds.

In most cases the buyer will pay 2139 and the seller will pay 2139. Who pays property transfer tax in Philadelphia. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly.

The City has the right to collect 100 of the tax from either party so its in the best interest of the buyer to make sure the tax is. 1259 approved June 11 1987. Who Pays Transfer Taxes in Pennsylvania.

Deed transfers and entity transfers have their own unique forms. The realty transfer tax is a joint and several tax in that all parties to the transaction seller and buyer are responsible for the payment of the tax. In most cases the buyer will pay 2139 and the seller will pay 2139.

This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly. Realty Transfer Tax The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278.

The tax is usually split evenly between the buyer and the seller but this is not a legal requirement. The City has the right to collect 100 of the tax from either party so its in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale. Philadelphias transfer tax is one of the highest rates within pennsylvania.

The Philadelphia Realty Transfer Tax was imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended by Bill No. 567 approved June 5 1985 and Bill No. The City has the right to collect 100 of the tax from either party so its in the best interest of the buyer to make sure the tax is paid in full at the closing of the sale.

The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. The tax rate is one percent for the state and one percent for the local portion however larger localities charge a higher local rate. Both grantor and grantee are held jointly and severally liable for payment of the tax.

Complete the correct certificate and submit it when you record the deed or mail in your Realty Transfer Tax. When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax. Who pays transfer tax in Philadelphia.

Philadelphias transfer tax is one of the highest rates within Pennsylvania. In Philadelphia Pennsylvania both buyers and sellers are responsible for real estate transfer taxes. Philadelphias transfer tax is one of the highest rates within pennsylvania.

The Realty Transfer Tax applies to the sale or transfer of real estate located in Philadelphia. This transfer tax is traditionally split between the buyer and the seller with each party paying half and becomes payable when the property deed or another document showing ownership is filed with the Record of Deeds. The total transfer tax rate in Pittsburgh is 5 while the transfer tax rate in Philadelphia is 4278.

Additionally each local entity has its own processing andor recording fees. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. The state of Pennsylvania receives one percent of the overall sales price and the remaining one percent is typically split evenly between the school district and local government for a total of two percent of the selling price.

Philadelphia also charges a deed recording fee of 25675. The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278. Luckily it is customary but not legally required for the buyer and seller to split the transfer taxes evenly.

Despite the fact that the sales contract requires it most buyers and sellers share the expense of the deed transfer tax 5050.

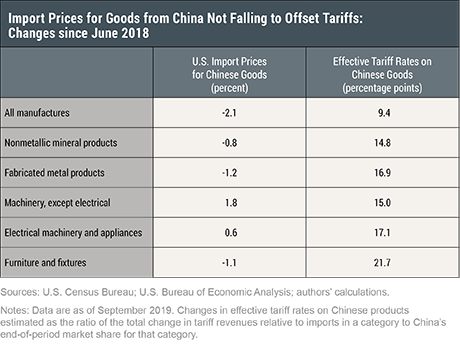

Council Tax Free Months 2022 Why Don T You Pay Council Tax In February Marca

![]()

Pennsylvania Horse Farm State Parks Creek Park

My Tenant Left Without Paying Bills So Now What

Deciding Where To Retire Affects Both Your Lifestyle And Your Wallet During Retirement Part Of Successfully Planning Your Tax Deductions Tax Refund Tax Return

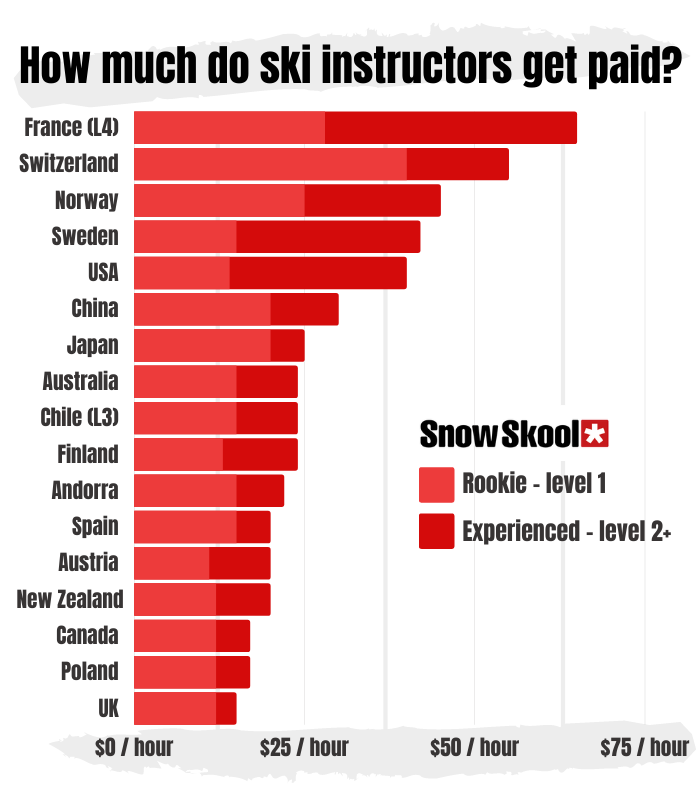

Ski Instructor Salaries How Much Do Ski Instructors Earn

Nancy Zieman The Blog Celebrating Nancy Zieman Exhibit On Display This Summer In Wisconsin Nancy Zieman Sewing With Nancy Quilt Shop Displays

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Pennsylvania Real Estate Transfer Taxes An In Depth Guide

Payroll Check Template Check More At Https Nationalgriefawarenessday Com 14394 Payroll Check Template Payroll Checks Payroll Template Payroll Software

Top 10 Highest Paying Accounting Careers Brighton College

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Top Ppp Loan Lenders Updated Approved Banks Providers

How Do I Do Payroll As Self Employed Hourly Inc

What Are Real Estate Transfer Taxes Forbes Advisor

Who Pays The Tax On Imports From China Liberty Street Economics

2 Trillion Stimulus Deal Reached 19 Things You Need To Know About Your Check Money Template Ways To Get Money Payroll Template